Microsoft gains a key advantage with its acquisition of Microsoft’s handset and devices division today: control. Microsoft itself says that acquiring the phones business helps it highlight “high value experiences” on devices around its mobile operating software, and cites the need for a “first-rate Microsoft phone experience” for users. Control over both software and hardware is what ensures those advantages, and that’s a lesson Microsoft learned from longtime rival Apple, which once upon a time entered the smartphone market and ate the bottom out of Microsoft’s mobile business.

Why Unify?

Apple’s main advantage, and the one that has given it the chance to rise to its current position of prominence in both the PC and smartphone markets, has always been its reluctance to license its software for use on third-party OEM hardware. In keeping both its mobile and its desktop OS the specific province of its own devices, it can ensure that it the software and the hardware are perfectly attuned to one another.

This tuning simplifies the update process, guarantees less OS fragmentation, normalizes hardware specifications (which leads to more predictable and consistent software experiences) and generally just makes sure that every time someone is using a Microsoft Windows Phone, they’re seeing and experiencing exactly what Microsoft’s software engineers intended.

Microsoft Cedes To BYOD

Another big reason for Microsoft to pick up a mobile hardware division is to capitalize on bring-your-own-device (BYOD) trends that are helping to erode its enterprise presence currently. The company says in its press deck explaining the rationale behind the deal that combining devices with “high volume/value services” is the best way to increase its user base, and this means developing a better strategy for adapting to the consumerization of IT.

Apple is essentially the archetype for BYOD success. The company’s devices, both iOS and Mac, have infiltrated formerly MS-dominated schools, businesses and government offices, fuelled by a bottom-up adoption of their software, services and gadgets by users who have Mac and home and were dissatisfied with their experience at work. Microsoft needs to win these customers back in both arenas to grow more aggressively, and it perceives total control of all aspects of its mobile business as a key necessary component for that to happen.

Halo Effect

Microsoft is behind the rest of the market in a number of ways, especially when it comes to tablets and apps. The company sees smartphone success as a key component in those other lines of business, as well as in helping to rejuvenate the somewhat stagnant PC market. In other words, Microsoft is chasing the Apple “halo effect” with this Nokia mobile business acquisition.

Redmond fully admits to this strategy in its press materials. Per its strategic rationale deck:

- Success in phones is important to success in tablets

- Success in tablets will help PCs

Microsoft seems to have tried to skip one of these steps, or else leave it to outside parties (the phone component) and hoped the Surface could both amp up its tablet business and bolster flagging PC sales. The Surface has not been a breakout success, however, which brings us to the next point.

Surface Level Problems

Nokia said that it had been considering alternative plans for its hardware division since Microsoft announced the Surface. Nokia interim CEO Risto Siilasmaa said during Nokia’s press conference around the deal that it came to the conclusion that the mobile phone hardware division needed to be “tightly aligned with the software ecosystem” and attendant services in order to compete.

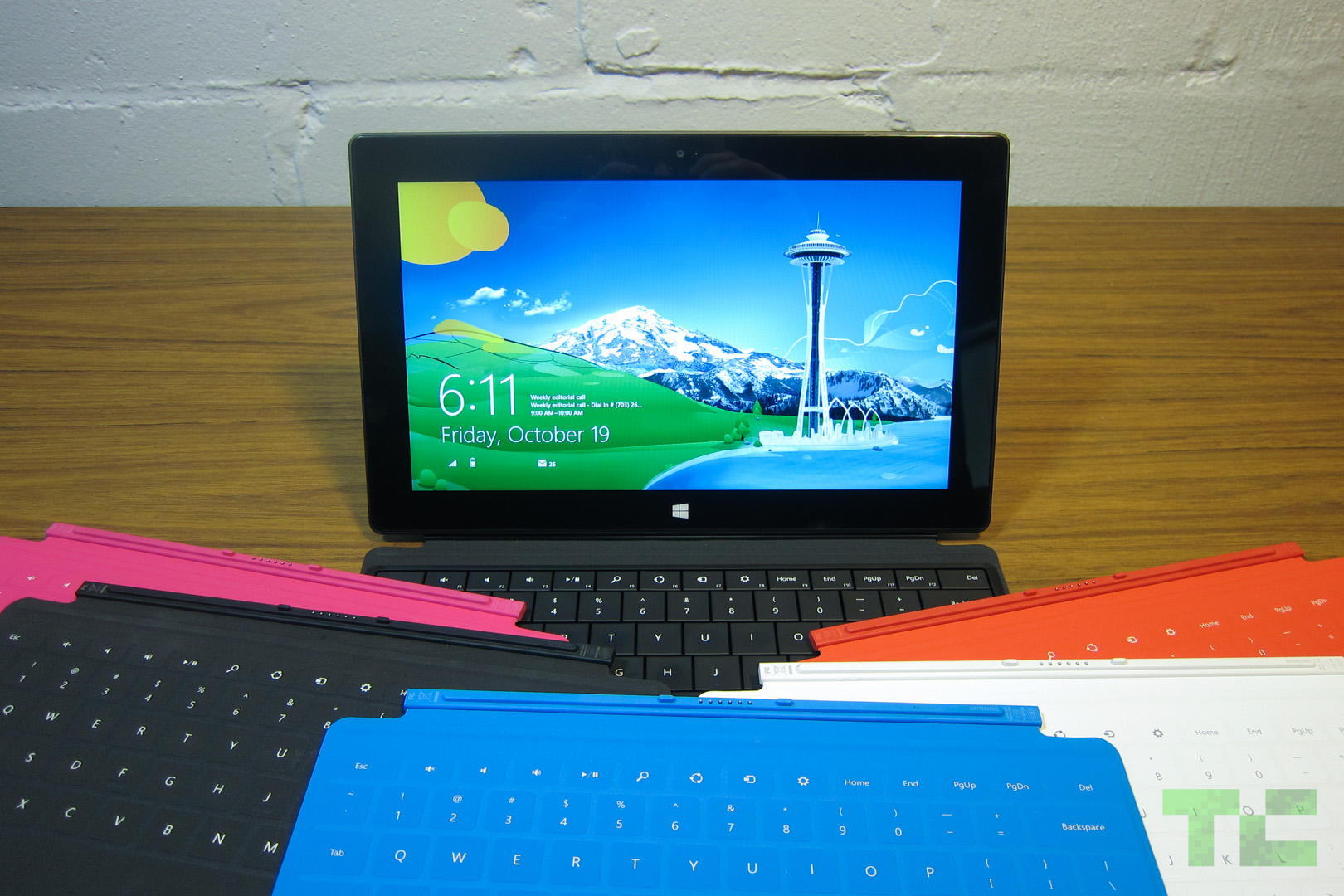

It’s interesting that the Surface was the stated progenitor of this deal, when Surface stands as the one example of how Microsoft has already behaved when it took the reins with holistic hardware and software design. The Surface and Surface RT tablets were designed as showcase devices that could reveal the power of Windows 8, a radical redesign of Windows with features designed for crossover touchscreen devices. But Surface hasn’t done amazingly well, with MS taking a $900 million writedown of inventory on Surface devices during its last fiscal quarter. Microsoft CEO Steve Ballmer is bullish on phone business, however, and where it stands pre-acquisition.

It’s interesting that the Surface was the stated progenitor of this deal, when Surface stands as the one example of how Microsoft has already behaved when it took the reins with holistic hardware and software design. The Surface and Surface RT tablets were designed as showcase devices that could reveal the power of Windows 8, a radical redesign of Windows with features designed for crossover touchscreen devices. But Surface hasn’t done amazingly well, with MS taking a $900 million writedown of inventory on Surface devices during its last fiscal quarter. Microsoft CEO Steve Ballmer is bullish on phone business, however, and where it stands pre-acquisition.

“Windows Phone has grown over 78 percent over the last year,” Ballmer said on stage during the Nokia conference. “Sales of Nokia Windows Phones have gone from literally zero two years ago to 7.4 million units in the most recently reported quarter.”

Ballmer essentially re-iterated that Microsoft believes strong phone sales will lift all boats in terms of the rest of the company’s services, software and hardware businesses, and that this acquisition and the alignment of phone hardware and software will help to accomplish that.

Business As Usual For Nokia’s Mobile Hardware Biz?

Despite the big changes, Microsoft seems fairly happy with Nokia’s Windows Phone performance so far, and in fact even before this deal it had significant influence not only on Windows Phone device specifications, but also on design, TechCrunch has heard from sources close to the companies. All of this suggests that Microsoft taking over entirely with mobile hardware won’t necessarily change the course of Lumia devices all that dramatically.

Nokia has done better with Microsoft hardware than Microsoft has, in the end, and we could see the new Nokia assets and employees given more control over Microsoft’s hardware destiny as a result. There’s a Nokia Windows tablet supposedly in the works already, in fact, so Microsoft may have bought itself into a position where it can take the hardware reins without overturning the stagecoach.

But the fact remains that Microsoft hasn’t shown it can succeed with an Apple-style approach; in fact, quite the opposite. It’s positioning taking over its own destiny with respect to mobile devices as a way to boost its ecosystem in a bid to eventually make the Windows Phone platform more attractive for outside OEMs, which is different from Apple’s angle, but in the short-term, the goal of building devices that best showcase its software and services remains the same. Microsoft has already false-started on that same goal with the Surface – whether Nokia can help it avoid the same pitfall with phones remains to be seen.