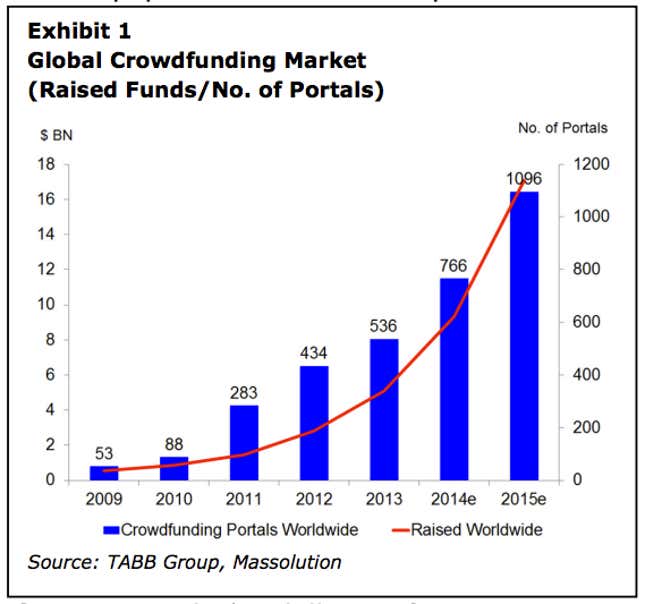

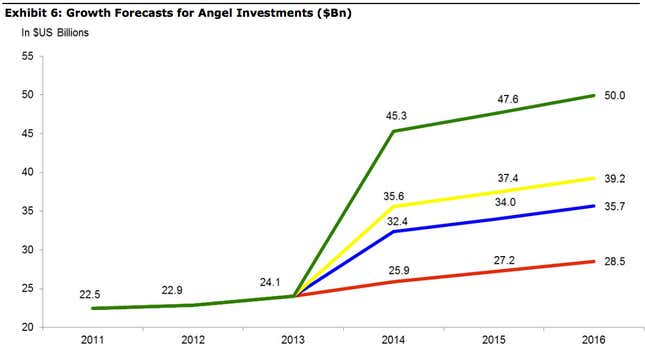

Peer-to-peer lenders may be in for boom times. The type of social-driven lending that helped fund flashy startups such as virtual-reality goggles maker Oculus VR could more than double over the next few years, according to research from the Tabb Group. Oculus was scooped up by Facebook for a cool $2 billion less than a month ago after receiving its original funding through the crowd-funding company Kickstarter. Tabb, in a recent report, estimates that the crowdsourcing market could hit around $17 billion globally by 2015, with more than 1,000 funding organizations formed to raise money. That would represent an eye-popping 200% increase in crowd-funding and an 88% increase in the number of lending venues throughout the world, Tabb says: Angel investors (mostly so-called “accredited,” high-net-worth folks who pass a set of financial thresholds) will provide some of the crowd-sourced funding and, across all funding paths, as much as $50 billion in financing in 2015, up from $22.9 billion in 2012. A more conservative growth estimate puts 2015 angel investments at $28 billion in 2015.

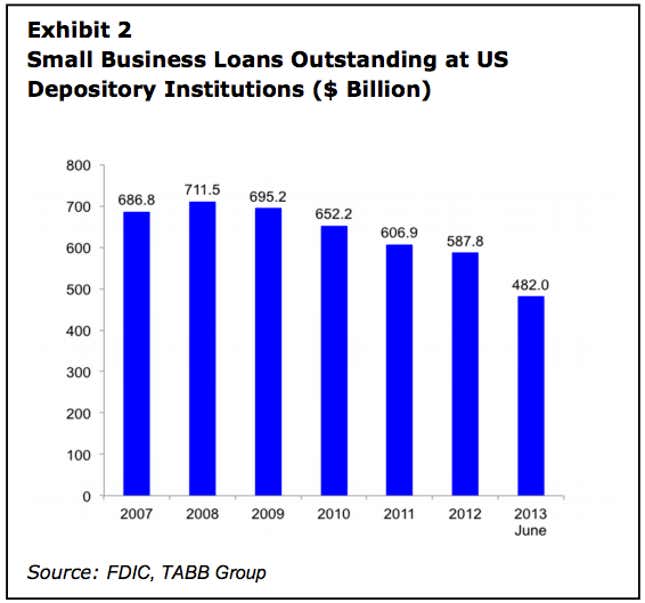

Social lending outfits such as Kickstarter and Indiegogo, as well as organizations such as Lending Club, would benefit from new general solicitation rules enacted last year. Under the new rules, which were mandated by the JOBS Act, the Securities and Exchange Commission (SEC) permits private companies to advertise widely in order to raise funds from “accredited” investors, generally those with a net worth of at least $1 million excluding the value of a residence. (There are still some restrictions on such advertising, explained by the SEC here.) Crowd-sourced funding would also benefit from the SEC’s proposed framework for rules that would allow lower-net-worth, “non-accredited” individuals to invest in private enterprises. Under those rules, crowd-funding would be allowed though a registered broker or lending portal, and with limitations on how much the “non-accredited” investors could plunk down. It’s also possible that crowd-sourced lending would benefit indirectly from new leverage ratio rules which require traditional US lenders to hold more capital in reserve. Tougher bank capital requirements already are taking their toll on the volume of small business loans originated by banks. As the chart below indicates small business lending has fallen by 32% from a 2008 peak of $711.5 billion. Crowd funders appear more than happy to fill the void being left by traditional lenders.