Last week's decision by Burger King to accompany its acquisition of Canadian coffee and doughnut chain Tim Hortons with the transfer of its Miami headquarters to Canada – a so-called corporate inversion – has dramatically reignited the US debate about how Washington should tax American multinationals.

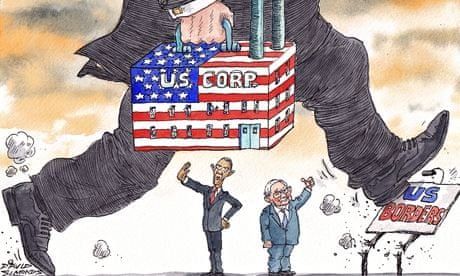

The development came as a blow for those who had hoped to have shamed and tamed corporate America into losing its recent appetite for inversions. Campaigners, led by President Barack Obama, had condemned such moves as dishonourable and damaging to America. The president last month promised new laws to close "this unpatriotic tax loophole for good".

The tide seemed to be turning with these outraged voices, as Wall Street analysts frantically began penning research notes speculating on whether the current crop of planned inversions may be derailed by fresh legislation from Washington.

Speculation over the future of inversions hardened when US pharmacy group Walgreens decided earlier this month to ignore tax advice suggesting it should use its full takeover of European rival Alliance Boots as an opportunity to switch headquarters out of the US. Such a move, chief executive Greg Wasson said, "was not in the best long-term interest of our shareholders", adding that he was aware of the risk of a public backlash given Walgreens was an "iconic American consumer retail company".

It seemed for a moment that the flood would be restricted and would certainly not involve any big consumer company.

That view could not have been more wrong. Corporate America had not been cowed. And Burger King – a very conspicuous consumer brand – has set out to prove it. And If that were not challenge enough to the anti-inversion camp, the fast food deal was to be done with the financial backing of the Warren Buffett-led investment powerhouse Berkshire Hathaway.

The involvement of the veteran investor – America's second wealthiest man, known as the Sage of Omaha – creates a big problem for Obama: Buffett is a talismanic figure in America, an investment tycoon whose folksy charm and manifest success have created a following not just in Wall Street but main street as well.

And on the subject of tax, in particular, his integrity and judgment are widely held to be unimpeachable. It was Buffett's endorsement, after all, that the Obama administration had held up as it pushed through higher taxes for America's very top-earning households – a measure popularly known as the "Buffett rule".

Buffett and Burger King have stressed that tax benefits were only marginal in their consideration of where to locate the headquarters of the combined business. And it is certainly true that the tax logic of the transfer pales in comparison to tax motivations behind a string of other inversion deals announced in recent months, such as drug-maker AbbVie's takeover of London-listed Shire and Liberty Media's acquisition of UK-based Virgin Media.

The pro-inversion camp have seized on this development, its confidence suddenly brimming.

Days after the Burger King deal was announced, Heather Bresch, chief executive of generic drugs maker Mylan – another US firm pursuing an inversion deal – was on the attack. "When I hear things like 'unpatriotic,' I just chalk it up to a lot of political rhetoric," she said. "The reality is the move [to the Netherlands] we are making will maintain the jobs that we not only have here in the US but allow us to continue to expand." The Mylan boss also condemned the US tax system as "dysfunctional and uncompetitive" and welcomed a public debate that "lights a fire" under the issue.

It seems likely that control of the patriotic high ground on tax reform is likely to become a hot political issue as the US inches closer to election mode. Many in corporate America are advocating changes that would allow multinationals to repatriate, at attractively low rates of taxation, multibillion-dollar cash piles held offshore. The money, they argue, could then be reinvested in America.

The problem is that these huge reserves are themselves often the product of complex tax engineering. To allow repatriation at low rates may represent a significant erosion of the US tax base, opening the floodgates to more bad behaviour.

A better solution might be greater tax harmonisation internationally, reducing incentives for global tax shenanigans. The G20 finance ministers meet next month and are expected to receive an update on a major project being carried out to reform global tax guidelines by the OECD. Focusing political energies behind this effort, rather than debating on the domestic stage, would be the best outcome. It's a shame politics rarely works that way.

Apple keeps it crisp

'Wish we could say more", reads the typically gnomic line on Apple's invitation to an event on 9 September. Observers and analysts expect a larger-screened iPhone and some sort of "wearable" device. Watch? Fitness tracker? Mobile payments adjunct?

Stockbrokers might wish Apple would say more, though they do pretty well from it even when it doesn't. The stock keeps hitting record highs, propelled by a combination of leaks from the company's Asian supply chain and expectation about the wearable thing sprinkling something extra on the giant cake of profits.

Apple's apparently unstoppable share price might look like the "greater fool" dynamic in action. Its profits growth has stalled. The iPad has seen sales fall for two quarters. The purchase of headphone maker Beats for $3bn looks like a mismatch of a music-oriented business with a consumer electronics one.

Staying with the bigger picture, the iPhone generates about 50% of Apple's revenue (and possibly more of its profits). Even here, though, smartphone prices are falling as manufacturing expands, and phones running Google's Android software make up more than 80% of those sold. Apple's share of smartphone sales droops every summer, from a 17% high at Christmas to 12%.

But smartphones are taking over the market: as many now sell every quarter (around 300m) as in the whole of 2010, so Apple's shrinking share is still an expanding number. About a tenth of all mobile phones sold are iPhones, and the forthcoming unveiling is expected to boost that further, especially in Asia.

And Apple has another secret weapon: loyalty. Research group Kantar found that 93% of iPhone owners planning to upgrade are most likely to get an iPhone. That's miles ahead of Android.

Analysts, rivals and journalists might wish Apple would say more. But until the numbers start turning sharply downward – as with Samsung's smartphones suddenly stuttering in the second quarter – silence is still golden.

We meet again, Mr Johnson

A great trope of westerns, war movies or Bond films is the moment when the arch-villain, having manoeuvred the hero into a seemingly inescapable position, reaches for two glasses or the cigar box and proffers the hand of friendship, saying: "You know, you and I are really not so different..." Connoisseurs will have been delighted to see Heathrow try the tactic last week with Boris Johnson, the London mayor, just at the point where his ambitions for the Thames Estuary may have finally exhausted the patience of the Airports Commission. In an open letter, the chief executive entreated: "Boris, despite our differences, we have always agreed that London and the UK need a successful hub airport to compete." Back our third runway: ditch Gatwick. As any movie-lover could tell Heathrow, this ploy is usually destined for a swift rebuttal by the hero. The mayor on the other hand – now prospective MP for neighbouring Uxbridge, with 100,000 nearby jobs to consider – might just be tempted.