Page added on May 8, 2016

World Rig Count Still Falling

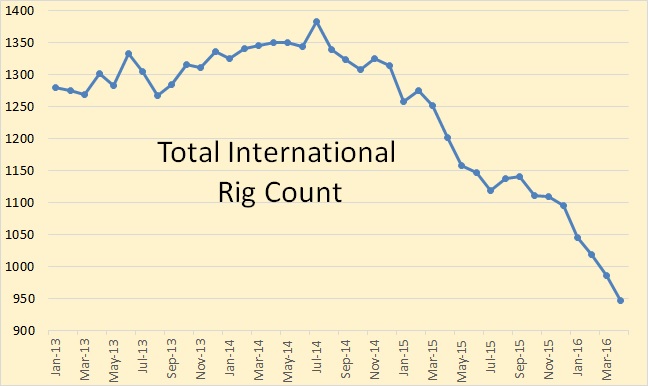

Baker Hughes recently published their International Rig Count. This rig count is at the end of April. It does not include the US, Canada, any of the FSU countries or inland China. The count includes both oil and gas rigs.

Total International Rigs stood at 946 in April, down 39 for the month and down 436 rigs since the latest peak in July 2014.

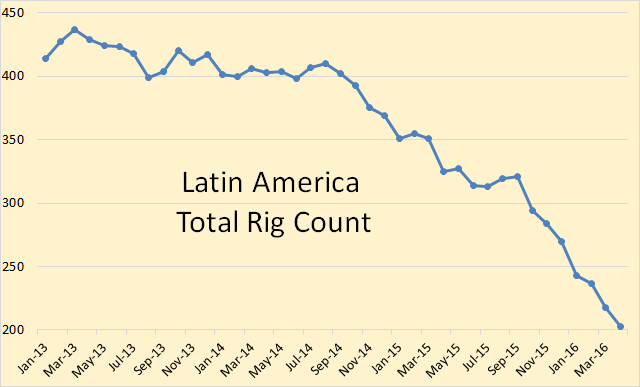

The Latin America rig count stood at 203 in April, down 15 rigs since April and down 204 since July 2014.

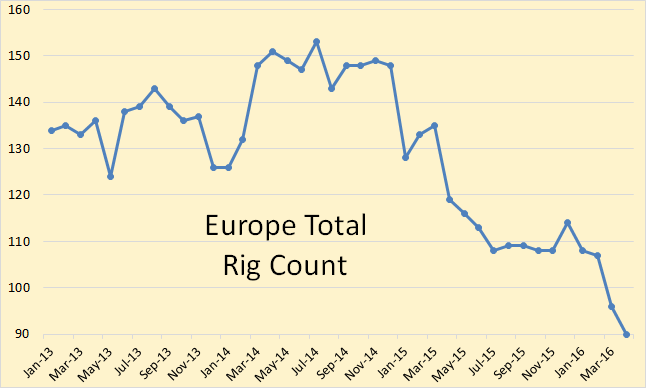

Europe rig count stood at 90 in April, down 6 in the last month and down 63 since July 2014.

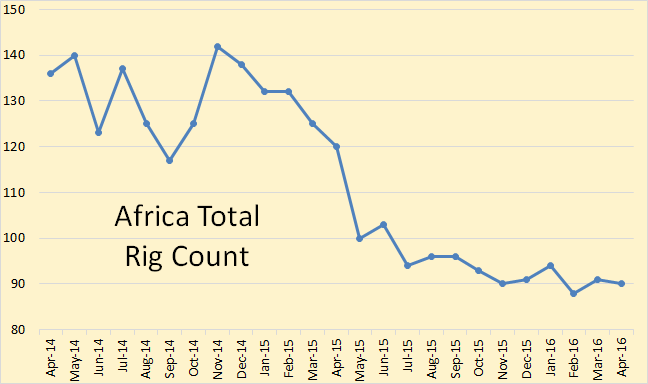

African rigs seem to have leveled out. They stood at 90 in April, down only 1 from March. Africa’s latest peak was in November 2014 and they are down 52 from that point.

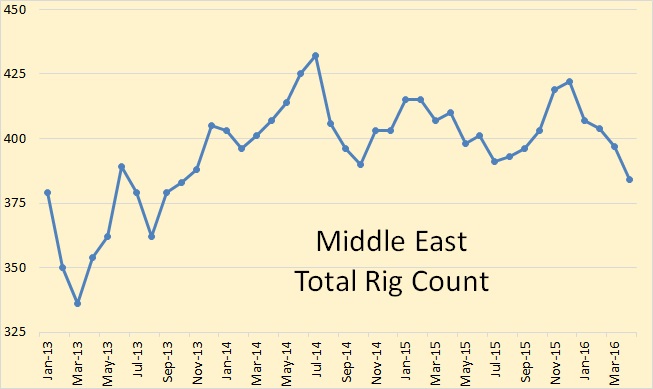

The Middle East rig count had been holding steady but dropped 13 rigs in April. That is down 48 rigs since their latest peak in July 2014.

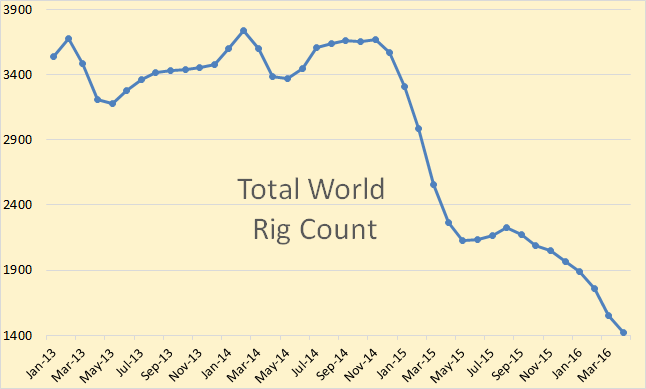

Baker Hughes’ total world rig count is just their total international rig count plus the US and Canada. It still does not include any FSU countries or inland China. The total world rig count did not start dropping until after November 2014 when it stood at 3,670 rigs. It is down 2,246 rigs since then and now stands at 1424 rigs after dropping 127 rigs in April.

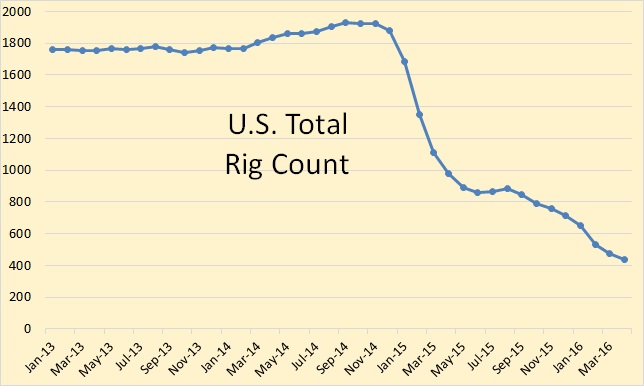

The US monthly rig count dropped 41 rigs from March to April and now stands at 437. The Count stood at 1,925 in November 2014 and is down 1,488 rigs since that point.

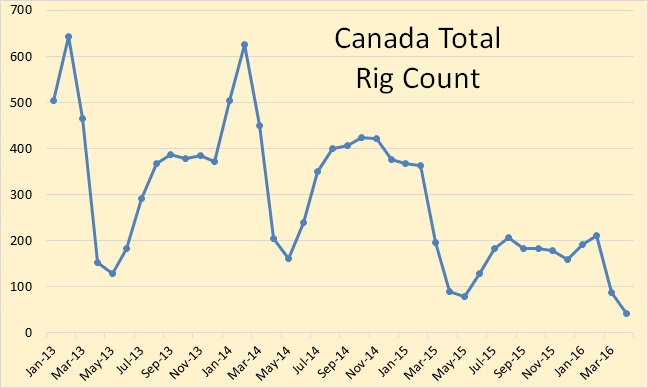

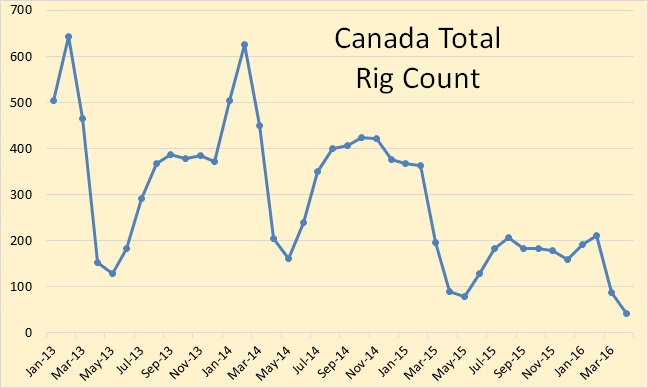

The Canadian rig count is highly seasonal and usually peaks in February. The last normal February peak was in 2014 when it peaked at 626 rigs. The 2016 February peak was 211 rigs. The March to April decline was 47 rigs and their total rig count now stands at just 41 rigs.

25 Comments on "World Rig Count Still Falling"

Kenz300 on Sun, 8th May 2016 11:43 am

going….going……broke…………

shortonoil on Sun, 8th May 2016 12:23 pm

In 2013, the last year for which we have figures, the world’s oil producers discovered and bought on line 4 Gb of the 32 Gb consumed. If we use rig count as a metric the world is now bringing 1.5 GB of new oil on line to replace the 34 it is consuming. That is 4.4%. Obviously, the oil age is ending!

AJY on Sun, 8th May 2016 12:48 pm

Wood Mackenzie reported 2.9 billion oil discoveries for 2015.

http://www.woodmac.com/media-centre/12531899

1.5 billion might be high for this year judging but what’s been reported to date (I think only 4 or 5 minor hits), We are at the tail of a fairly well defined bell curve for discoveries, and at some point, maybe soon, the E&P companies or their investors are going to realize it’s not worth the effort.

JuanP on Sun, 8th May 2016 12:57 pm

US land rig count, http://oilprice.com/Energy/Energy-General/Horizontal-Land-Rig-Count-Summary-6th-May-2016.html

Davy on Sun, 8th May 2016 1:25 pm

“Albert Edwards: “Let Me Tell You How This All Ends”

http://www.zerohedge.com/news/2016-05-08/albert-edwards-let-me-tell-you-how-all-ends

“Edwards concludes by setting the scene for what is to come…”

Let me tell you how all this ends. It ends with investors accepting that they can pretend no longer and profits are sliding into recession. It ends as the equity market spirals into a deep bear market as company management reach the end of the road in the face of the recessionary conditions and ‘kitchen sink’ years of EPS manipulation. It ends as corporate bond spreads explode as years of excess debt accumulation lead to widespread corporate bankruptcies, making the recession much deeper. It ends with social unrest and double digit budget deficits (again). It ends with investors losing faith with the Fed as the resumption of QE proves ineffective in reviving the economy. It ends in deeply negative interest rates, currency and trade wars, helicopter money and ultimately inflation.

“In a nutshell, it ends badly.”

“One final thought: On the front page of the Fitchburg Sentinel from July 31 1920, an exuberant business press headlined: “Ponzi will not reveal business secret.” This was published less than a month before Charles Ponzi’s scheme blew up. As Edwards concludes, actually, isn’t this exactly what central banks have done over the last few years to the financial markets?”

shortonoil on Sun, 8th May 2016 3:43 pm

“Wood Mackenzie reported 2.9 billion oil discoveries for 2015.”

Here is the Wood Mackenzie quote

“just 2.9 billion barrels of liquids were discovered globally in 2015.”

Liquids: which ones? We estimate that at least a third of shale production has an API greater than 45. API 45 and greater fluids don’t make fuels. They are feedstock material; they have a net energy return of about zero!

http://www.nrcan.gc.ca/sites/www.nrcan.gc.ca/files/energy/images/eneene/sources/petpet/images/refraf1-lrgr-eng.png

We estimate that by 2030 world “oil” production will be about 20 mb/d. The world is not running out of liquid hydrocarbons, it is running short of crude that can be processed into fuels.

http://www.thehillsgroup.org/

Boat on Sun, 8th May 2016 4:14 pm

Generally speaking 40 to 45 API gravity degree oils have the greatest commercial value because they are rich in gasoline. Condensates are worth slightly less because the natural gasoline has a lower octane value. Heavier crudes are worth less because they require more refinery processing. West Texas Intermediate (WTI) is the benchmark crude oil used by the United States to set prices and compare other oils. It has 38 to 40 API gravity.

GregT on Sun, 8th May 2016 5:11 pm

And all of them have less value, the higher the production costs, and the more energy required to produce them.

makati1 on Sun, 8th May 2016 6:52 pm

EROEI…

$RO$I is what is killing oil. Fraking is leading the way.

Boat on Sun, 8th May 2016 9:48 pm

gregt,

Thats wrong, heavier crudes with an api of 30 and under require more processing. Condensate brings almost as much in the market as wti, (api 38) and more than heavier crudes.

Boat on Sun, 8th May 2016 9:50 pm

In 2015, the average API gravity for domestic refinery inputs was about 32 degrees, as refiners blended heavy and light crude oils to make a medium-grade feedstock. As discussed in EIA’s report, Technical Options for Processing Additional Light Tight Oil Volumes Within the United States, U.S. refineries have accommodated much of the growth in U.S. crude production from 2010 to 2014 with two limited- or no-investment-cost options: displacing imports of crude oil (primarily light crude oil, but also medium crude oil) from countries other than Canada and increasing refinery utilization rates.

https://www.eia.gov/todayinenergy/detail.cfm?id=26132

GregT on Sun, 8th May 2016 10:17 pm

Boat,

Stop, and think.

http://1.bp.blogspot.com/–o2teIsGnyY/UT5GcFFIhrI/AAAAAAAAGj8/Efs5dEPHxd8/s1600/STOPANDTHINK.jpg

It isn’t the volume of oil, or the API of the oil that matters. It is the cost to produce the oil and the energy available to our economies that matter. All of the oil in the world with an API of 32 degrees makes no fucking difference in the universe, if it is not affordable to our economies of scale, or if the EROEI is less than around 6:1.

There is reason why our economies are going down the toilet Kevin. Ignoring reality will not change anything.

Boat on Sun, 8th May 2016 11:10 pm

My point is this condensate called camel pee is more valuable than the heavy oil. Here is yet another report that claims US will use another added 750,000 of condensate in 2016.

https://www.afpm.org/uploadedFiles/Refining-US-Capacity.pdf

GregT on Sun, 8th May 2016 11:11 pm

And also Boat,

If you are going to use somebody else’s writings, you should use quotation marks ( ” “), otherwise it could be considered to be plagiarism. Even if their writings are complete BS.

GregT on Sun, 8th May 2016 11:18 pm

“My point is this condensate called camel pee is more valuable than the heavy oil.”

It doesn’t matter how valuable something might be Boat, if economies of scale cannot afford it.

makati1 on Mon, 9th May 2016 12:04 am

If you don’t have any money to spend on anything but food and shelter, they could be selling gold bars for $1 a kilo and there would be no buyers. “Dollar Value” means nothing. Boat cannot seem to understand what ‘no money’ means, but I think he is soon to find out.

shortonoil on Mon, 9th May 2016 6:25 am

“In 2015, the average API gravity for domestic refinery inputs was about 32 degrees,”

The average input to domestic refineries is API 32 because that is the way it is blended. It is what is needed to get it through the pipes of the refinery. It is the way they were designed. It has absolutely nothing to do with the average API at the well head.

Your claim that condensate is more valuable than crude is ridiculous. Condensate (also called natural gasoline if produced from an NG plant) is 98% pentane (C5H12) and has an API of 92.7. It has an energy content (exergy) of 108,000 BTU per gallon, as opposed to 37.5 ° crude with an energy content of 140,000 BTU per gallon. It has always sold at a deep discount to conventional crude. It is the primary component for the production of polystyrene, a high impact plastic.

There appears to be a number of people who want to be petroleum prognosticators, who have never bothered to learn anything about petroleum!

http://www.thehillsgroup.org/

shortonoil on Mon, 9th May 2016 6:46 am

“Generally speaking 40 to 45 API gravity degree oils have the greatest commercial value because they are rich in gasoline.”

Gasoline is not the profit point of refineries, it is diesel where they make their money. Gasoline is a low profit, highly competitive market. It has one of the lowest crack spreads of any product that they produce. Most of the world uses diesel, and that is where refineries try to maximize their production. API 40 to 45 does not make diesel:

http://www.nrcan.gc.ca/sites/www.nrcan.gc.ca/files/energy/images/eneene/sources/petpet/images/refraf1-lrgr-eng.png

European refineries see gasoline as a by product, and ship it to the US. The world is awash in gasoline. The higher API of shale is not helping the oversupply problem, it is aggravating it.

When you learn something about petroleum come back, and see us. In the mean time – try hitting the books. Some form of an education would be enhance your presence tremendously!

rockman on Mon, 9th May 2016 7:24 am

mak – “$RO$I (and not EROEI) is what is killing oil”. You have learned well, grasshopper. LOL.

Davy on Mon, 9th May 2016 7:50 am

Looks like oil technicals are pointing to a price correction:

http://www.zerohedge.com/news/2016-05-09/bofa-says-its-time-sell-wti-crude-price-target-low-35-heres-why

JuanP on Mon, 9th May 2016 9:00 am

GregT “And all of them have less value, the higher the production costs, and the more energy required to produce them.”

Thanks for the laugh, Greg. It is always nice to read something like that. Boat is lost looking at the trees, he needs to take a break and see the forest. But, then again, if he could see the forest, he wouldn’t be Boat, would he?

Not all value is monetary. It is possible to make an economic profit by selling a product that does more damge than good in today’s world. 😉

Dredd on Mon, 9th May 2016 9:09 am

“World Rig Count Still Falling”

Sea level is too in some locations (The Warming Science Commentariat – 3).

The connection is not obvious.

Kenz300 on Mon, 9th May 2016 10:02 am

Canadian tar sands are the high cost producers……..but they keep producing…………..

The deep pockets of the Koch brothers and others keep them going………….

Maybe the wild fires will have an impact………and end this costly, wasteful and damaging impact on the Climate.

New Documents Show Oil Industry Even More Evil Than We Thought

http://www.huffingtonpost.com/entry/oil-cover-up-climate_us_570e98bbe4b0ffa5937df6ce

Climate Change is real….. we will all be impacted by it.

Oil Giants Spend $115 Million A Year To Oppose Climate Policy

http://www.huffingtonpost.com/entry/oil-companies-climate-policy_us_570bb841e4b0142232496d97

The Kochs Are Plotting A Multimillion-Dollar Assault On Electric Vehicles

http://www.huffingtonpost.com/entry/koch-electric-vehicles_us_56c4d63ce4b0b40245c8cbf6

Inside the Koch Brothers’ Toxic Empire | Rolling Stone

http://www.rollingstone.com/politics/news/inside-the-koch-brothers-toxic-empire-20140924?page=2

Boat on Mon, 9th May 2016 10:42 am

JaunP,

It seems to me after much reading that condensate is a valuable commodity for producing energy. Not only that but great for gasoline. One project at a time. I don’t have a goal of debunking shot. It just happens.

Boat on Mon, 9th May 2016 11:09 am

short,

“Gasoline is not the profit point of refineries, it is diesel where they make their money.”

“The world is awash in gasoline. The higher API of shale is not helping the oversupply problem, it is aggravating it”.

As a car driver this is reassuring. For those wanting the world to collapse will have to wait on climate change.