Hundreds of thousands of Australians could share in the nation’s biggest class action, which has been launched against a number of banks over late payment fees.

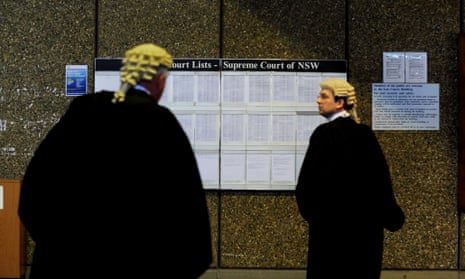

Legal firm Maurice Blackburn has launched the action in the NSW supreme court, to cover all customers of Westpac, St George, Citibank, BankSA and ANZ, who have ever been charged a credit card late payment fee.

Andrew Watson, who heads Maurice Blackburn’s class action practice, says the move follows an earlier class action where a court found fees were a penalty and excessive and that customers were entitled to the difference between what they were charged and the true cost to the bank.

“We are really taking the fight to the banks on behalf of consumers, who have been levied, for years, these late payment fees,” he said on Tuesday.

Watson says the previous action, which class action members had to sign up to, covered 185,000 customers of the various banks.

“This action will be many times bigger because it will cover anyone who, at any stage, has been charged a late payment fee on a credit card,” he said.

Watson said he didn’t know the size of the potential compensation payout should the action be successful but said it would be substantial.

“Our current estimate for the sign-up case was $243m and so many view this case is worth substantially more.”

Watson said the actual size of the case was to be determined, but it was the biggest class action in Australia.

“It’s too early to tell how it will stack up in terms of any compensation paid, but clearly in terms of the numbers of people involved, this is the largest class action in Australian history,” he said.

“You just have to comprehend we’re effectively talking about any bank customer of these major banks, and in the future it will be others as well, who has ever paid a late-payment fee on a credit card.”

Watson said the class action included those who were not part of the successful claim earlier this year.

“The February action was for those who signed up. This is for everybody who has not signed up.”

Watson said action against other banks was also on the cards.

“We will be taking action against other banks as we identify appropriate lead applicants who can lead up those actions.”

He said that even though February’s decision to award compensation for late payment fees was subject to an appeal, due to be heard next week, it would not affect the decision to launch the current legal claim.

“This is not jumping the gun. This is an action which we have taken as part of a considered approach to ensuring that the rights of all customers of the banks are best preserved in the event that the appeal is successful,” he said.

Consumer Action Law Centre CEO Gerard Brody said the case built on the federal court finding that late fees charged by ANZ were unlawful, arguing a similar claim against other banks.

“This case should bring some justice to consumers,” Brody told ABC Radio.

He said some banks charge up to $20 or more for late payments but the court in the ANZ case found the actual cost of administering the late payment was “more like 35 cents”.

“These sort of late payment fees can’t be all out of proportion,” he said.

“They could charge a $1 or $2 fee, and that would still probably be lawful.

“But we shouldn’t have late fees worth 20, 30 or 40 dollars.”

Comments (…)

Sign in or create your Guardian account to join the discussion