Datastream

Ranked: The Top Online Music Services in the U.S. by Monthly Users

The Briefing

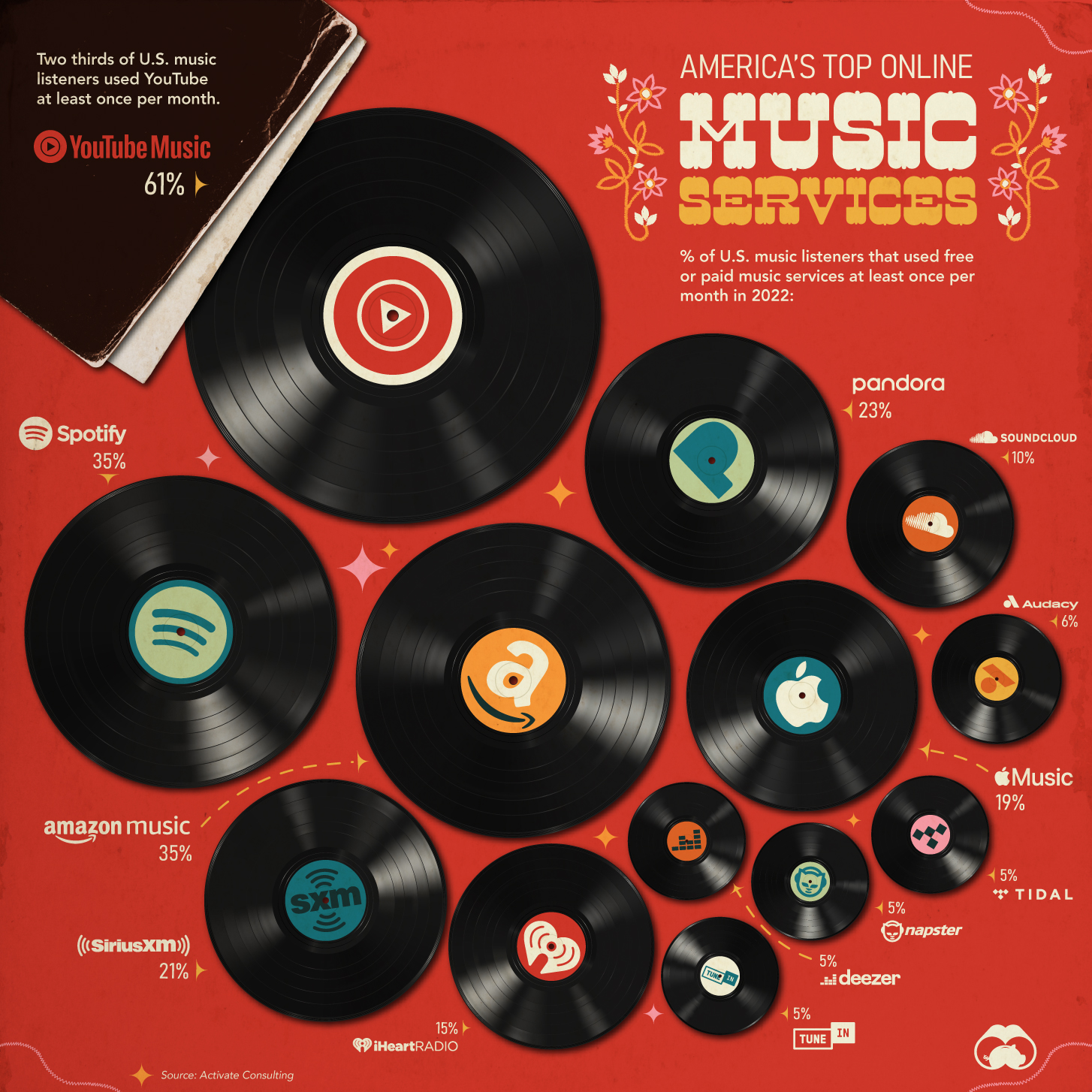

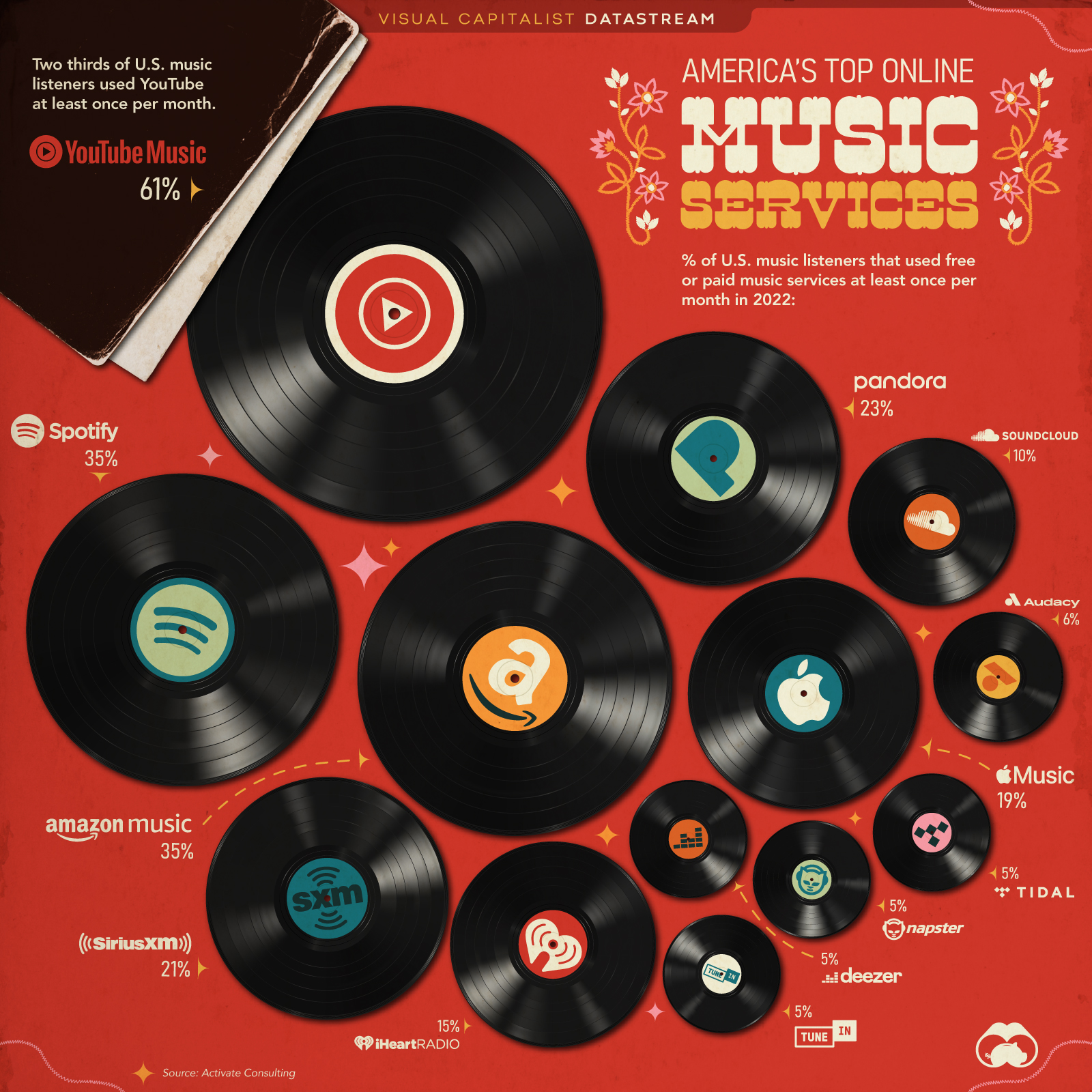

- Two-thirds of music listeners in the U.S. used YouTube at least once per month

- 64% of music listeners use multiple music services per month

The Top Online Music Services in the U.S.

The music streaming industry is characterized by fierce competition, with many companies vying for market share.

Companies are competing on multiple fronts, from price and features to advertising and exclusive content, making it a challenging market for companies to succeed in.

YouTube (the standard offering and YouTube Music) has the highest amount of users, attracting around two-thirds of music listeners in the U.S. during a given month. This is largely due to the YouTube’s massive reach and extensive catalog of music.

Here’s a full rundown of the top music streaming services in the U.S. by monthly listeners:

| Rank | Music Service | % of U.S. Music Listeners Who Use Monthly |

|---|---|---|

| #1 | YouTube | 61% |

| #2T | Spotify | 35% |

| #2T | Amazon Music | 35% |

| #4 | Pandora | 23% |

| #5 | SiriusXM | 21% |

| #6 | Apple Music | 19% |

| #7 | iHeartRadio | 15% |

| #8 | SoundCloud | 10% |

| #9 | Audacity | 6% |

| #10T | TuneIn | 5% |

| #10T | Deezer | 5% |

| #10T | Napster | 5% |

| #10T | Tidal | 5% |

Two companies are in the running for second place: Spotify and Amazon Music.

Spotify leads in one important metric: number of paid users. Meanwhile, Amazon Music has a large user base since the service is bundled into Prime—however, recent changes mean that without a premium subscription, shuffled playback is the primary option. Time will tell what impact those changes will have on the service’s market share.

Prices for premium music services are beginning to creep upward. Apple Music and Amazon Music raised their prices, and it’s rumored that Spotify will not be far behind. This move would be significant because, in the U.S., Spotify hasn’t raised its prices in over a decade.

Rising prices and more aggressive promotion of premium subscriptions could be a signal that music streaming services are transitioning from a focus on capturing market share to monetizing existing users.

Where does this data come from?

Source: Activate Technology and Media Outlook 2023 by Activate Consulting

Data note: “Music services” include free and paid services used for listening to music through any format excluding terrestrial radio. “Music listeners” are defined as adults aged 18+ who spend any time listening to music.

Datastream

Charting the Rise of Cross-Border Money Transfers (2015-2023)

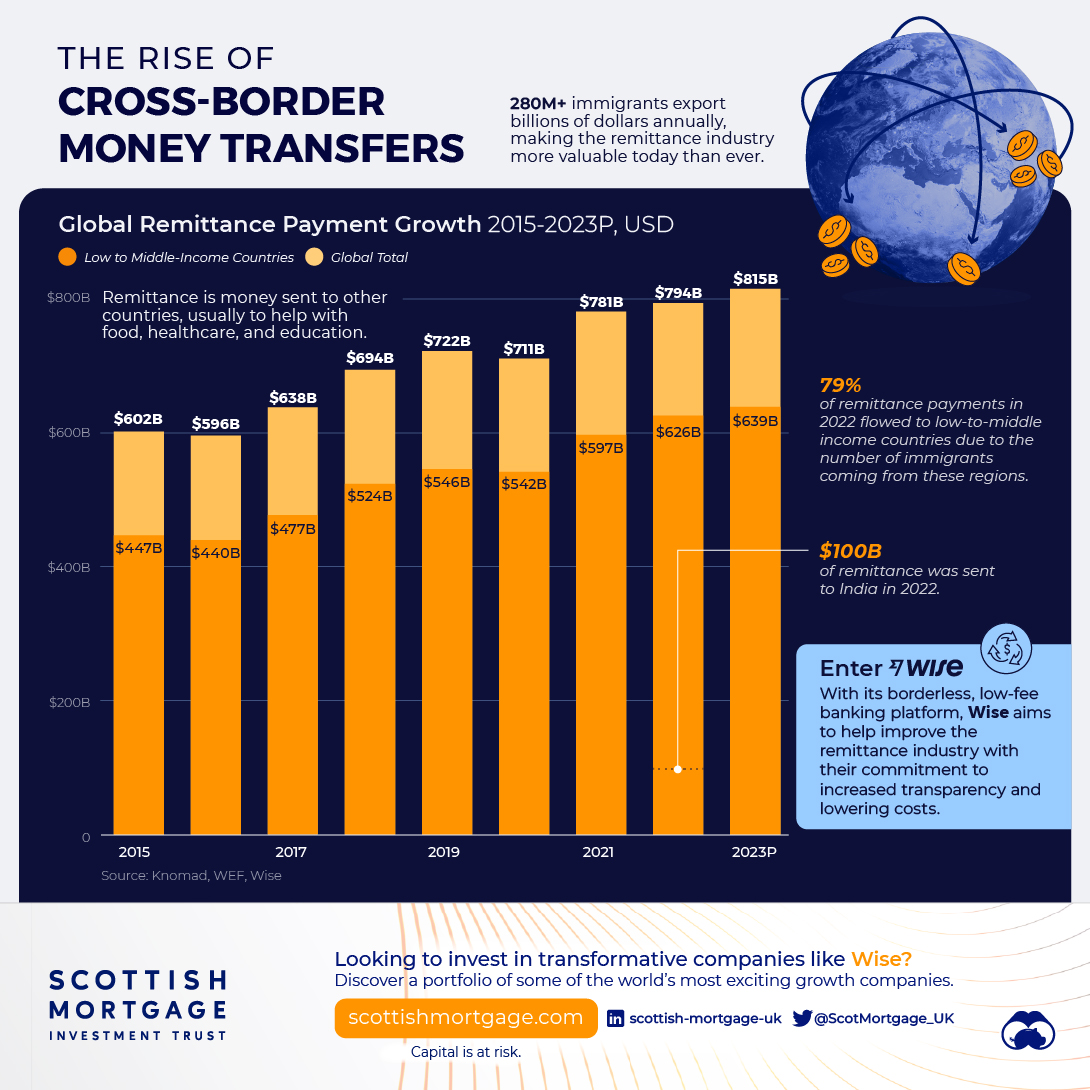

With over 280 million immigrants transferring billions of dollars annually, the remittance industry has become more valuable than ever.

The Briefing

- 79% of remittance payments in 2022 were made to low and middle-income countries.

- Borderless, low-cost money transfer services like those provided by Wise can help immigrants support their families.

The Rise of Cross-Border Money Transfers

The remittance industry has experienced consistent growth recently, solidifying its position as a key component of the global financial landscape. Defined as the transfer of money from one country to another, usually to support a dependent, remittances play a pivotal role in providing food, healthcare, and education.

In this graphic, sponsored by Scottish Mortgage, we delve into the growth of the remittance industry, and the key factors propelling its success.

Powered by Immigration

With over 280 million immigrants worldwide, the remittance industry has an important place in our global society.

By exporting billions of dollars annually back to their starting nations, immigrants can greatly improve the livelihoods of their families and communities.

This is particularly true for low and middle-income countries, who in 2022 received, on average, 79% of remittance payments, according to Knomad, an initiative of the World Bank.

| Year | Low/Middle Income (US$ Billion) | World Total (US$ Billion) |

|---|---|---|

| 2015 | $447B | $602B |

| 2016 | $440B | $596B |

| 2017 | $477B | $638B |

| 2018 | $524B | $694B |

| 2019 | $546B | $722B |

| 2020 | $542B | $711B |

| 2021 | $597B | $781B |

| 2022 | $626B | $794B |

| 2023 | $639B | $815B |

India is one of the global leaders in receiving remittance payments. In 2022 alone, over $100 billion in remittances were sent to India, supporting many families.

Enter Wise

As the global remittance industry continues to grow, it is important to acknowledge the role played by innovative money transfer operators like Wise.

With an inclusive, user-centric platform and competitive exchange rates, Wise makes it easy and cost-effective for millions of individuals to send money home, worldwide.

Connection Without Borders

But Wise doesn’t just offer remittance solutions, the company offers a host of account services and a payment infrastructure that has helped over 6.1 million active customers move over $30 billion in the first quarter of 2023 alone.

Want to invest in transformative companies like Wise?

Discover Scottish Mortgage Investment Trust, a portfolio of some of the world’s most exciting growth companies.

-

Best of6 days ago

Best of6 days agoBest Visualizations of April on the Voronoi App

-

Brands2 weeks ago

Brands2 weeks agoHow Tech Logos Have Evolved Over Time

-

Energy2 weeks ago

Energy2 weeks agoRanked: The Top 10 EV Battery Manufacturers in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoCountries With the Largest Happiness Gains Since 2010

-

VC+2 weeks ago

VC+2 weeks agoVC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

-

Demographics2 weeks ago

Demographics2 weeks agoThe Countries That Have Become Sadder Since 2010

-

Money2 weeks ago

Money2 weeks agoCharted: Who Has Savings in This Economy?

-

Technology1 week ago

Technology1 week agoVisualizing AI Patents by Country